These Are The Nations With The Highest (And Lowest) Marginal Income Tax Rates

It’s tax filing time for quite a few countries, as their financial year comes to end.

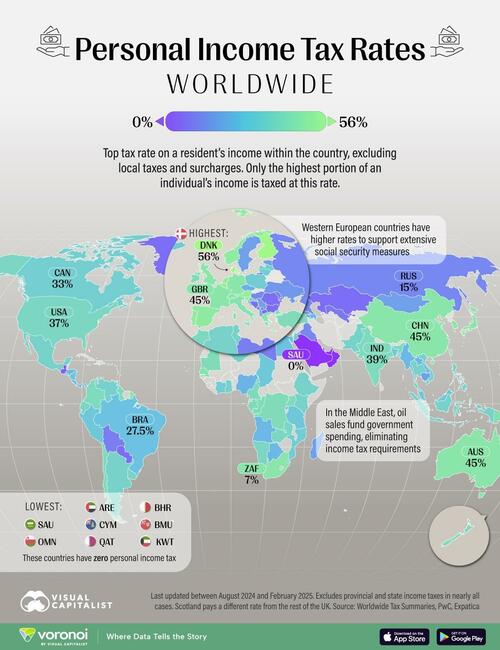

How differently do countries tax their citizens? Visual Capitalist’s Pallavi Rao took a look at the top marginal individual income tax rates of nearly 150 countries to compare and contrast differences.

Data for this map is sourced from PwC’s Worldwide Tax Summaries, updated between Aug 2024–Feb 2025.

Of course there are limitations to the data. Only the highest portion of an individual’s income is taxed at this rate, and brackets vary significantly on how much money falls into that pool.

Furthermore, property, sales, or other indirect taxes are not included. It also omits state, provincial, and municipal taxes

Ranked: Countries by their Highest Personal Income Tax Rate

Western European countries on average have the highest headline income tax rates in the world.

Per the source, seven countries have a 50%+ top rate, and six of those are in Europe, led by Denmark at 55.9%.

| Rank | Country | ISO Code | Headline Personal Income Tax Rate |

|---|---|---|---|

| 1 |  Denmark Denmark |

DNK | 55.9 |

| 2 |  Finland Finland |

FIN | 55 |

| 3 |  Luxembourg Luxembourg |

LUX | 51 |

| 4 |  Austria Austria |

AUT | 50 |

| 5 |  Belgium Belgium |

BEL | 50 |

| 6 |  Israel Israel |

ISR | 50 |

| 7 |  Slovenia Slovenia |

SVN | 50 |

| 8 |  Netherlands Netherlands |

NLD | 49.5 |

| 9 |  Portugal Portugal |

PRT | 48 |

| 10 |  Norway Norway |

NOR | 47.4 |

| 11 |  Spain Spain |

ESP | 47 |

| 12 |  Switzerland Switzerland |

CHE | 45.5 |

| 13 |  Australia Australia |

AUS | 45 |

| 14 |  China China |

CHN | 45 |

| 15 |  Germany Germany |

DEU | 45 |

| 16 |  France France |

FRA | 45 |

| 17 |  UK UK |

GBR | 45 |

| 18 |  Japan Japan |

JPN | 45 |

| 19 |  South Korea South Korea |

KOR | 45 |

| 20 |  South Africa South Africa |

ZAF | 45 |

| 21 |  Greece Greece |

GRC | 44 |

| 22 |  Italy Italy |

ITA | 43 |

| 23 |  Senegal Senegal |

SEN | 43 |

| 24 |  Papua New Guinea Papua New Guinea |

PNG | 42 |

| 25 |  Chile Chile |

CHL | 40 |

| 26 |  DRC DRC |

COD | 40 |

| 27 |  Congo Congo |

COG | 40 |

| 28 |  Gabon Gabon |

GAB | 40 |

| 29 |  Guyana Guyana |

GUY | 40 |

| 30 |  Ireland Ireland |

IRL | 40 |

| 31 |  Mauritania Mauritania |

MRT | 40 |

| 32 |  New Caledonia New Caledonia |

NCL | 40 |

| 33 |  Türkiye Türkiye |

TUR | 40 |

| 34 |  Taiwan Taiwan |

TWN | 40 |

| 35 |  Uganda Uganda |

UGA | 40 |

| 36 |  Colombia Colombia |

COL | 39 |

| 37 |  India India |

IND | 39 |

| 38 |  New Zealand New Zealand |

NZL | 39 |

| 39 |  Cameroon Cameroon |

CMR | 38.5 |

| 40 |  Morocco Morocco |

MAR | 38 |

| 41 |  Ecuador Ecuador |

ECU | 37 |

| 42 |  Namibia Namibia |

NAM | 37 |

| 43 |  U.S. U.S. |

USA | 37 |

| 44 |  Zambia Zambia |

ZMB | 37 |

| 45 |  Uruguay Uruguay |

URY | 36 |

| 46 |  Croatia Croatia |

HRV | 35.4 |

| 47 |  Argentina Argentina |

ARG | 35 |

| 48 |  Cyprus Cyprus |

CYP | 35 |

| 49 |  Algeria Algeria |

DZA | 35 |

| 50 |  Ethiopia Ethiopia |

ETH | 35 |

| 51 |  Ghana Ghana |

GHA | 35 |

| 52 |  Indonesia Indonesia |

IDN | 35 |

| 53 |  Kenya Kenya |

KEN | 35 |

| 54 |  Mexico Mexico |

MEX | 35 |

| 55 |  Malta Malta |

MLT | 35 |

| 56 |  Pakistan Pakistan |

PAK | 35 |

| 57 |  Philippines Philippines |

PHL | 35 |

| 58 |  Thailand Thailand |

THA | 35 |

| 59 |  Tunisia Tunisia |

TUN | 35 |

| 60 |  Vietnam Vietnam |

VNM | 35 |

| 61 |  Venezuela Venezuela |

VEN | 34 |

| 62 |  Canada Canada |

CAN | 33 |

| 63 |  Latvia Latvia |

LVA | 33 |

| 64 |  Puerto Rico Puerto Rico |

PRI | 33 |

| 65 |  Eswatini Eswatini |

SWZ | 33 |

| 66 |  Côte d’Ivoire Côte d’Ivoire |

CIV | 32 |

| 67 |  Lithuania Lithuania |

LTU | 32 |

| 68 |  Mozambique Mozambique |

MOZ | 32 |

| 69 |  Poland Poland |

POL | 32 |

| 70 |  Iceland Iceland |

ISL | 31.35 |

| 71 |  Bangladesh Bangladesh |

BGD | 30 |

| 72 |  Jamaica Jamaica |

JAM | 30 |

| 73 |  Jordan Jordan |

JOR | 30 |

| 74 |  Saint Lucia (assumed “Saint”) Saint Lucia (assumed “Saint”) |

KNA | 30 |

| 75 |  Malaysia Malaysia |

MYS | 30 |

| 76 |  Nicaragua Nicaragua |

NIC | 30 |

| 77 |  Peru Peru |

PER | 30 |

| 78 |  Rwanda Rwanda |

RWA | 30 |

| 79 |  El Salvador El Salvador |

SLV | 30 |

| 80 |  Chad Chad |

TCD | 30 |

| 81 |  Tanzania Tanzania |

TZA | 30 |

| 82 |  Barbados Barbados |

BRB | 28.5 |

| 83 |  Brazil Brazil |

BRA | 27.5 |

| 84 |  Cabo Verde Cabo Verde |

CPV | 27.5 |

| 85 |  Egypt Egypt |

EGY | 27.5 |

| 86 |  Angola Angola |

AGO | 25 |

| 87 |  Azerbaijan Azerbaijan |

AZE | 25 |

| 88 |  Botswana Botswana |

BWA | 25 |

| 89 |  Costa Rica Costa Rica |

CRI | 25 |

| 90 |  Dominican Republic Dominican Republic |

DOM | 25 |

| 91 |  Gibraltar Gibraltar |

GIB | 25 |

| 92 |  Equatorial Guinea Equatorial Guinea |

GNQ | 25 |

| 93 |  Honduras Honduras |

HND | 25 |

| 94 |  Laos Laos |

LAO | 25 |

| 95 |  Lebanon Lebanon |

LBN | 25 |

| 96 |  Myanmar Myanmar |

MMR | 25 |

| 97 |  Panama Panama |

PAN | 25 |

| 98 |  Slovakia Slovakia |

SVK | 25 |

| 99 |  Trinidad & Tobago Trinidad & Tobago |

TTO | 25 |

| 100 |  Nigeria Nigeria |

NGA | 24 |

| 101 |  Singapore Singapore |

SGP | 24 |

| 102 |  Albania Albania |

ALB | 23 |

| 103 |  Czechia Czechia |

CZE | 23 |

| 104 |  Liechtenstein Liechtenstein |

LIE | 22.4 |

| 105 |  Isle of Man Isle of Man |

IMN | 22 |

| 106 |  Armenia Armenia |

ARM | 20 |

| 107 |  Estonia Estonia |

EST | 20 |

| 108 |  Georgia Georgia |

GEO | 20 |

| 109 |  Guernsey Guernsey |

GGY | 20 |

| 110 |  Jersey Jersey |

JEY | 20 |

| 111 |  Cambodia Cambodia |

KHM | 20 |

| 112 |  Madagascar Madagascar |

MDG | 20 |

| 113 |  Mongolia Mongolia |

MNG | 20 |

| 114 |  Mauritius Mauritius |

MUS | 20 |

| 115 |  Serbia Serbia |

SRB | 20 |

| 116 |  Sweden Sweden |

SWE | 20 |

| 117 |  Ukraine Ukraine |

UKR | 18 |

| 118 |  Hong Kong Hong Kong |

HKG | 16 |

| 119 |  Hungary Hungary |

HUN | 15 |

| 120 |  Iraq Iraq |

IRQ | 15 |

| 121 |  Montenegro Montenegro |

MNE | 15 |

| 122 |  Palestinian Territories Palestinian Territories |

PSE | 15 |

| 123 |  Russia Russia |

RUS | 15 |

| 124 |  Bolivia Bolivia |

BOL | 13 |

| 125 |  Libya Libya |

LBY | 13 |

| 126 |  Macau Macau |

MAC | 12 |

| 127 |  Moldova Moldova |

MDA | 12 |

| 128 |  Uzbekistan Uzbekistan |

UZB | 12 |

| 129 |  Bulgaria Bulgaria |

BGR | 10 |

| 130 |  Bosnia & Herzegovina Bosnia & Herzegovina |

BIH | 10 |

| 131 |  Greenland Greenland |

GRL | 10 |

| 132 |  Kazakhstan Kazakhstan |

KAZ | 10 |

| 133 |  North Macedonia North Macedonia |

MKD | 10 |

| 134 |  Paraguay Paraguay |

PRY | 10 |

| 135 |  Romania Romania |

ROU | 10 |

| 136 |  Timor-Leste Timor-Leste |

TLS | 10 |

| 137 |  Kosovo Kosovo |

XKX | 10 |

| 138 |  Guatemala Guatemala |

GTM | 7 |

| 139 |  UAE UAE |

ARE | 0 |

| 140 |  Bahrain Bahrain |

BHR | 0 |

| 141 |  Bermuda Bermuda |

BMU | 0 |

| 142 |  Cayman Islands Cayman Islands |

CYM | 0 |

| 143 |  Kuwait Kuwait |

KWT | 0 |

| 144 |  Oman Oman |

OMN | 0 |

| 145 |  Qatar Qatar |

QAT | 0 |

| 146 |  Saudi Arabia Saudi Arabia |

SAU | 0 |

Note: Denmark’s figure includes a mandatory labor market tax for all wage earners in the country. Scotland pays a different rate than the rest of the UK.

But as always, the fine print contains more useful information. For example, in Denmark, the top bracket for employment income is 15%. However, this combines with the bottom bracket tax and mandatory healthcare and municipal contributions to raise the income tax ceiling. Finally, income from shares and dividends also attracts a high rate of 42%.

In the U.S., the 37% headline rate is only applicable to income above $609,000 for individuals. Of course, U.S. states tax their residents as well.

And finally, several Middle Eastern countries—also oil producers—don’t charge an income tax.

The Pros and Cons of Western Europe’s High Tax Rates

Individual income taxes often make up the largest source of government revenues.

Thus, higher taxes help fund extensive public services like healthcare, education, and social security.

It can also potentially reduce income inequality by redistributing wealth, supporting lower-income citizens, and fostering social cohesion.

However, less disposable income leads to less consumer spending. And better-skilled workers with higher earnings may relocate, leading to brain drain from the region.

High earners can avoid taxes by routing their incomes or businesses through low tax jurisdictions. Check out Ranked: The World’s Top 10 Tax Havens to see how much offshore wealth is parked around the globe.

Tyler Durden Sun, 03/09/2025 – 07:35

Source: https://freedombunker.com/2025/03/09/these-are-the-nations-with-the-highest-and-lowest-marginal-income-tax-rates/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.