Mercedes Slides On Profit Plunge, Weak Car Guidance

Mercedes shares declined in Germany on Thursday after the struggling automaker reported a nearly one-third drop in 2024 profits, pressured by softening demand in China and sluggish electric vehicle sales. Analysts at Bernstein characterized the 2025 outlook for passenger cars as “predictably weak.”

Here’s a snapshot of the 2024 fiscal year financial results. The focus is on deteriorating EBIT margin (courtesy of Bloomberg):

-

Ebit EU13.60 billion, -31% y/y

-

Dividend per share EU4.30 vs. EU5.30 y/y, estimate EU4.32

-

Profit EU10.41 billion, -28% y/y, estimate EU9.87 billion

-

Sales EU145.59 billion, -4.5% y/y, estimate EU145.85 billion

-

Industrial free cash flow EU9.15 billion, estimate EU8.49 billion

-

Vans adjusted return on sales 14.6% vs. 15.1% y/y, estimate 14.8%

-

Vans adjusted Ebit EU2.83 billion, estimate EU2.87 billion

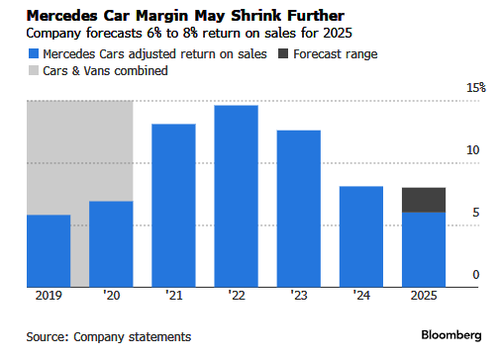

Mercedes announced plans to slash 10% of production costs through 2027 and provided a dismal outlook for this year. It expects lower sales and guided profit margins lower than Wall Street’s expectations…

2025 Forecast:

-

Sees Cars adjusted return on sales 6% to 8%, estimate 7.91% (Bloomberg Consensus)

-

Sees Vans adjusted return on sales 10% to 12%, estimate 12.8%

“To ensure the company’s future competitiveness in an increasingly uncertain world, we are taking steps to make the company leaner, faster and stronger,” CEO Ola Kallenius wrote in a statement.

With CEO Kallenius at the helm, Mercedes has prioritized producing higher-end vehicles while shifting away from entry-level models. There was a time—many years ago—when the automaker focused on building cars for executives. However, weak demand for Maybachs and G-Wagons in China and other markets has pressured this strategy.

Kallenius expects margins margins upwards of 10% by 2027. Like many others in Europe, automakers have been pressured by weakening global demand, a dismal economic environment in Germany, and Chinese competitors such as BYD. At the same time, trade tensions with the US are another headwind for EU automakers.

On Thursday, Mercedes shares in Germany fell as much as 3.8% in trading. Shares have been locked in a four-year lateral between 50 euros as the base and 75 euros as the ceiling.

Analyst commentary from Goldman’s George Galliers and others noted that 4Q24 “beat” but profit margin forecasts for this year are problematic:

-

Waiting for 2027 – Mercedes’ initial release provided limited disclosure with respect to today’s CMD content. MB confirmed that the next generation of products starts this year with the new CLA, to be followed by an upgrade of the S-Class in 2026 and BEV versions of the GLC and C-Class. The company expects sales to gain traction in 2027 on the back of the new products. In addition, MB plans to reduce production costs by 10% by 2027 and also take measures to tackle material costs and fixed costs over the same period.

-

Shareholder returns solid but no clarity yet on Trucks – Mercedes plans to buy back up to €5bn of shares within 24 months, subject to approval at the company’s AGM in May. MB stated that the buyback is in line with the existing policy, to return 100% of future ind. FCF above the dividend, and confirmed a continuation of a c.40% payout ratio. We wait to see if the CMD provides clarity on what MB plans for its Daimler Truck stake.

-

4Q24 group EBIT beat as Cars sees cost tailwinds – Mercedes reported 4Q24 group adj. EBIT of €3.53bn, 9.6% ahead of company-compiled consensus (€3.22bn, GSe €3.42bn). The beat was driven by Cars with adj. EBIT at €2.38bn (cons €2.21bn, GSe €2.34bn) leading to an 8.1% margin (cons 7.8%, GSe 8.1%). Looking at the Cars bridge, weaker Volume/Structure/Pricing -€780mn was offset by a better than expected performance on ind. costs €206mn (GSe €29mn). R&D also provided a tailwind at €273mn (GSe -€265mn). 4Q ind. FCF was strong at €2.90bn (cons €2.12bn, GSe €2.11bn) despite a limited contribution from WC. Mercedes declared a dividend of €4.30 for FY24 (GSe €4.50).

-

FY25 guide suggests negative revisions to estimates – Mercedes guided for group EBIT significantly below 2024, implying

More analyst commentary (courtesy of Bloomberg):

RBC (outperform)

- Analyst Tom Narayan writes that the buyside’s expectations were heightened into today’s investor event and some may have expected more on capital return, for example relating to the Daimler Truck stake

- Notes the miss in the van margin guidance for 2025

- Still, says the 4Q Ebit came in ahead of consensus and the company is calling for 2025 cars Ebit margins to be 7%, at the midpoint where consensus is

Bernstein (market-perform)

- Analysts led by Stephen Reitman say 2025 passenger cars guidance is “predictably weak” and in-line with their expectations, while vans guidance is a miss

- Say it’s a slight beat on the full-year results and the guidance, and notes the new buyback details

Citi (neutral)

- Analysts Harald Hendrikse and Soumava Banerjee say Mercedes is “at least fighting” its deteriorating Ebit margin trend and the share buyback program should shore up the firm’s earnings per share until 2027, when new products are meant to boost profitability

Separately, Europe’s largest automaker, Volkswagen, has also come under pressure, moving forward with cost-cutting measures to reduce 35,000 jobs in Germany by the end of the decade. Europe is a mess.

Tyler Durden Thu, 02/20/2025 – 10:05

Source: https://freedombunker.com/2025/02/20/mercedes-slides-on-profit-plunge-weak-car-guidance/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.