Banks Report Tighter Standards, Growing Loan Demand As Conditions Ease Some More

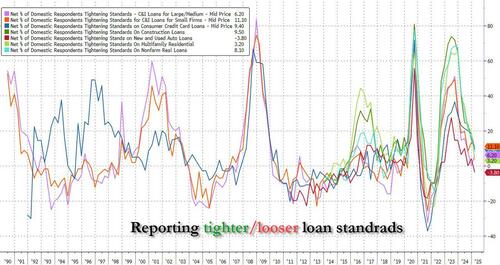

The last time we looked at the senior loan officer survey (SLOOS) back in November, we found that banks reported “unchanged lending standards for commercial and industrial (C&I) loans to large and middle-market firms and tighter standards for loans to small firms.” Meanwhile, banks reported weaker demand for C&I loans to firms of all sizes as well as tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

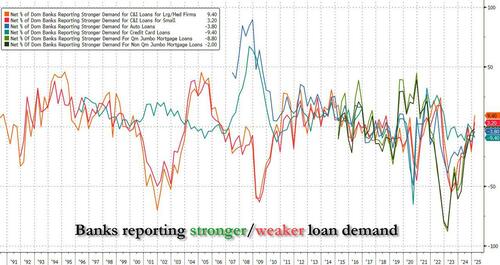

So fast forward to today when the latest closely watched SLOOS report for Q4 was published, and which found that there has been little change as respondents again reported “tighter lending standards for commercial and industrial (C&I) loans to firms of all sizes.” Meanwhile, banks reported stronger demand for C&I loans to large and middle-market firms, offset by demand for C&I loans to small firms which was basically unchanged. Furthermore, banks reported tighter standards and basically unchanged demand for commercial real estate (CRE) loans.

For loans to households, banks reported, “basically unchanged lending standards and weaker demand across most categories of residential real estate (RRE) loans.”

In addition, banks reported that standards tightened for credit card loans and remained basically unchanged for auto and other consumer loans, while demand weakened for credit card and other consumer loans but remained basically unchanged for auto loans. Finally, banks reported basically unchanged lending standards and demand for home equity lines of credit (HELOCs).

In short, flat to rising loan demand, tighter supply.

Separately, the January SLOOS included a set of special questions inquiring about banks’ expectations for changes in lending standards, borrower demand, and loan performance over 2025. Here, banks reported expecting lending standards to either ease or remain basically unchanged and demand to strengthen across all loan categories.

In addition, banks generally reported expecting loan quality to improve for loans to businesses but to either deteriorate or remain basically unchanged for most consumer loan types.

Regarding demand for C&I loans over the fourth quarter, a modest net share of banks reported stronger demand from large and middle-market firms, while demand from small firms remained basically unchanged on net. In addition, a moderate net share of banks reported an increase in the number of inquiries from potential borrowers regarding the availability and terms of new credit lines or increases in existing lines. Furthermore, a significant net share of foreign banks reported stronger demand for C&I loans.

The most frequently cited reasons for stronger demand, reported by major net shares of banks, were increased customer investment in plant or equipment and increased customer financing needs for inventory, accounts receivable, and merger or acquisition.

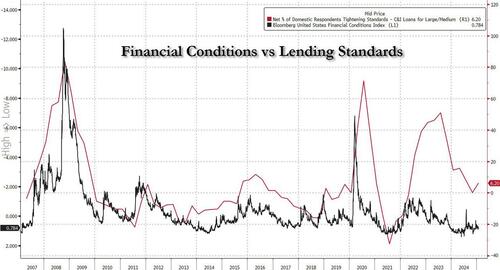

And yes, for those wondering, loan tightness is almost entirely a function of financial conditions: as the next chart shows, financial conditions have become far less tight in the past several quarters, tracking the easing in financial conditions.

Putting it all together, banks anticipate further tightening lending standards across most categories, even as consumer fight with each other for what little loan availability exists while scrambling to load up their credit cards with as much debt as possible before the next bust.

Source: Fed

Tyler Durden Mon, 02/03/2025 – 15:07

Source: https://freedombunker.com/2025/02/03/banks-report-tighter-standards-growing-loan-demand-as-conditions-ease-some-more/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.