Eurozone “Recovery” Still Ongoing

By Maartje Wijffelaars, Senior Eurozone Economist at Rabobank

As was widely expected, the ECB cut its policy rate yesterday by 25 basis points, bringing the deposit rate to 2.75%. The rate action followed an equal cut by the Bank of Canada earlier in the week, a 100bp hike by the Central Bank of Brazil and the Fed’s decision to keep its target range for the federal funds rate unchanged.

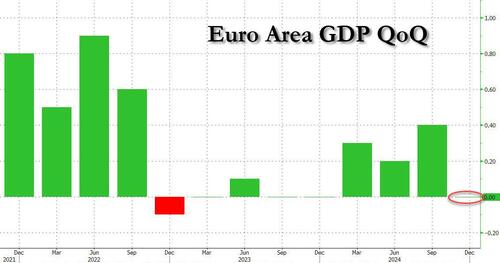

As our ECB-watcher Bas van Geffen notes in his post-meeting comment, incoming data had largely developed as the ECB expected. Data released yesterday indicate that Eurozone GDP had stagnated in Q4, but Lagarde noted that the recovery was “certainly” still ongoing.

Likewise, the slight uptick in Eurozone inflation “had been expected” by the Governing Council, and policymakers remain confident that inflation will reach the 2% target in the course of 2025. Lagarde acknowledged that domestic services inflation remains high, but she added that this is largely due to lagged adjustments of wages and prices.

With the economy largely developing as forecasted, the ECB still seems on track for gradual cuts towards neutral. Where the ECB expects this to be exactly, we may learn on February 7, when the ECB will publish a research paper on the neutral rate. At the World Economic Forum, the ECB President cited a range of 1.75% to 2.25%. At yesterday’s press conference Lagarde mentioned that the outcome of the research paper will certainly inform the Governing Council’s future discussions.

Importantly, although a 2% neutral rate would be a plausible estimate, we maintain our forecast of a 2.25% terminal rate for now. The ECB is gradually heading to this neutral rate, but we continue to see some lingering inflation risks that could stop the ECB at the upper end of their neutral range. According to our models, for example, a trade conflict with the US, would probably add to price pressures in the Eurozone. Furthermore, we note that energy prices and the prices of some agri commodities have recently increased. And in recent surveys, companies also reported renewed increases in input costs and selling prices.

The ECB’s growth outlook is pretty similar to ours. Policymakers expect consumption to pick up, although Lagarde said that growth is not expected to strengthen rapidly and that “consumer confidence is fragile”, with lower confidence possibly hampering investment and consumption.

As we wrote in a publication yesterday, we think that the Eurozone economy will perform somewhat better this year than in 2024, driven by a pickup in consumption. But surveys don’t paint a picture of an economy that has come out of the starting blocks yet.

Indeed, industrial weakness could bottom out this year, but a quick turnaround is unlikely. Some of last year’s headwinds may lessen, as monetary policy eases further and domestic demand benefits from increasing household purchasing power. Still, these headwinds will probably not disappear entirely. Order book levels are still very weak, energy prices remain relatively high and gas prices will in fact be higher this year than in 2024, structural competitiveness issues aren’t solved, German elections cast political uncertainty, and the global backdrop remains challenging to say the least.

Clearly, Trump’s foreign policies add an additional layer of uncertainty, which may dampen investment in the currency bloc – on top of the expected negative impact on trade and push to inflation we foresee. Conversely, the outlook could improve if the new German government -to be elected in February- is willing to tackle structural challenges, by softening the debt brake to facilitate the necessary spending.

Meanwhile our consumption forecast is supported by the outlook that real wages will continue to improve. But, importantly, it also hinges on the expectation that we won’t see large-scale job destruction across the euro area and that households propensity to consume increases. As we explain in the report there are several reasons why we think this is likely. But worsened employment expectations among surveyed businesses, stalling improvement in consumer confidence and growing unemployment concerns are all reasons to be cautious.

Tyler Durden Fri, 01/31/2025 – 10:20

Source: https://freedombunker.com/2025/01/31/eurozone-recovery-still-ongoing/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.