Consumer Credit Unexpectedly Surges By Most On Record Despite All-Time High APRs

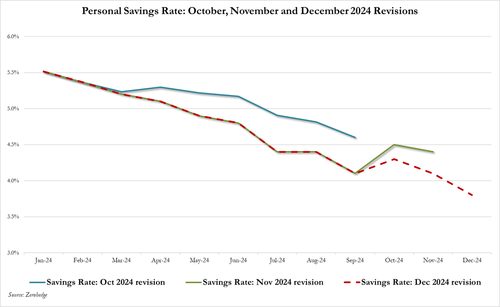

We have repeatedly warned that with their savings – and especially “emergency covid savings” – gone or nearly gone, Biden admin savings data manipulation notwithstanding…

… US consumers had no choice but to max out their credit cards in order to “extend and pretend” their moment of purchasing greatness, or as we called it two months ago, their last hurrah (see In “Last Hurrah”, Credit Card Debt Explodes Higher Despite Record High APRs As Savings Rate Craters), a hurrah that would last very briefly as it was only a matter of months if not weeks before said cards were denied.

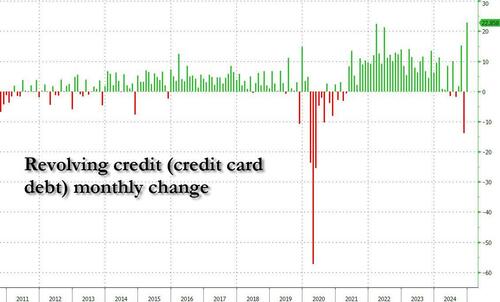

One month later, that’s exactly what happened, when to our surprise, revolving credit cratered at the fastest pace since the covid crash, contracting a whopping $7.5 billion, an event which for a country that lives on debt – literally - is unheard of outside of a recession.

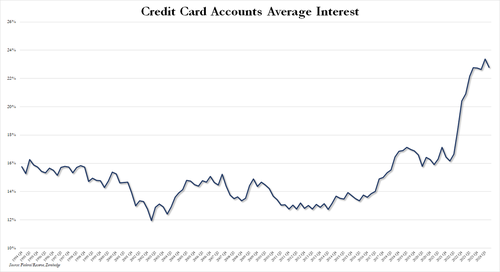

Commenting on the plunge, we said that “we don’t know what sparked this sudden reversal in the favorite American pastime – i.e., to buy stuff one can’t afford and hope to pay it back some time in the future for a modest 29.95% APR – but we know what didn’t: falling rates… because they didn’t.” We then proceeded to show that the average interest rate on credit card balances were at the second highest on record ever though the Fed had already cut rates by 100 bps.

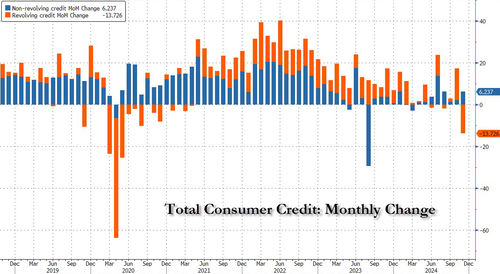

And while it would have been normal, if not expected, for credit card balances to continue declining with savings rates near record lows and with credit card rates at record highs, trust the US economy to do precisely the opposite of what is logical and according to the latest just released consumer credit data, US consumers exited 2024 with a bang after Consumer credit soared by a record $40.8 billion in December, a complete reversal of the $5.4 billion November drop, and a month that sticks out like a sore thumb in the history of consumer credit as shown below.

The December print is all the more remarkable when considering that Wall Street consensus was for a $14.6BN consumer credit print. This means that the actual number was a 4 sigma beat to expectations, the biggest on record for this particular data series

Taking a closer look at the number, while non-revolving debt (i.e. student and auto loans) rose modestly as it always does rising by $18 billion, it was revolving, or credit card debt, that cratered soared by a whopping $22.3 billion, a remarkable reversal to the $14 billion drop in November which was the biggest drop since the covid crash shut down the economy, and the biggest monthly increase on record.

And while last month’s unexpected drop could at least have been explained with the fact that credit card APRs were at all time highs (currently 23% up almost 10% from a decade again), the fact that APRs remained there just under a record high certainly does not explain why US consumers scrambled to max out their credit cards at the end of 2024, just as their savings accounts hit the lowest level in years.

While the surge in credit card usage may explain the burst in spending to end the year, there is only so far that an economy can be pushed with maxed out credit cards.

Tyler Durden Fri, 02/07/2025 – 15:46

Source: https://freedombunker.com/2025/02/07/consumer-credit-unexpectedly-surges-by-most-on-record-despite-all-time-high-aprs/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.